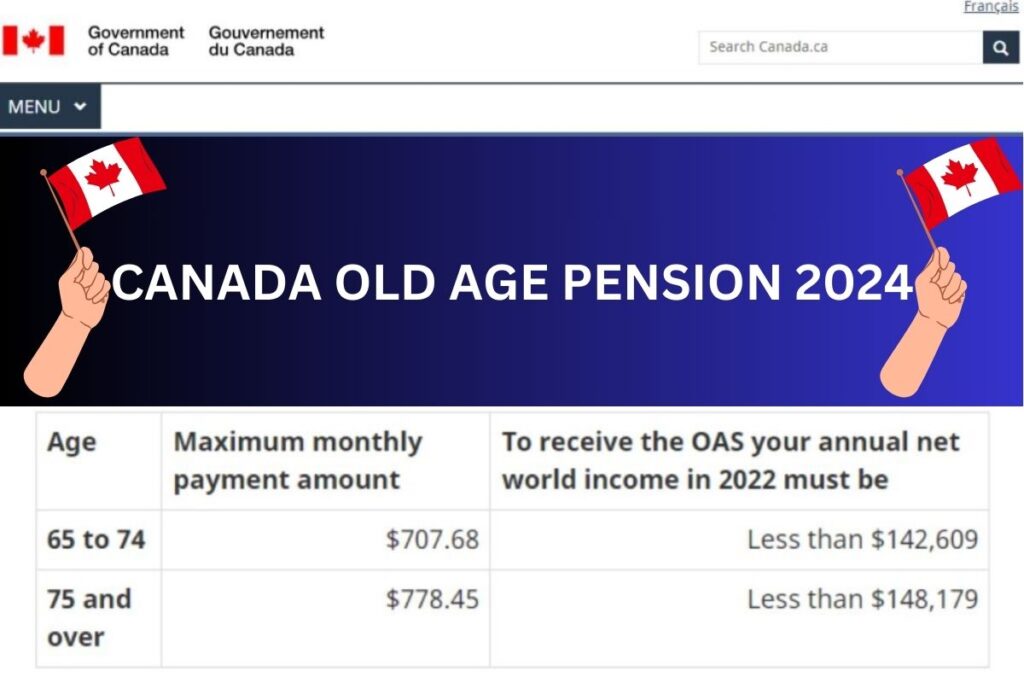

Canadians age 75 and older can receive up to a maximum of $784.67 per month. The maximum income to avoid oas clawback for 2025 is $90,977.

Old age security pension and benefits. It kicks in if your net annual income (line 234 on your income tax return) is.

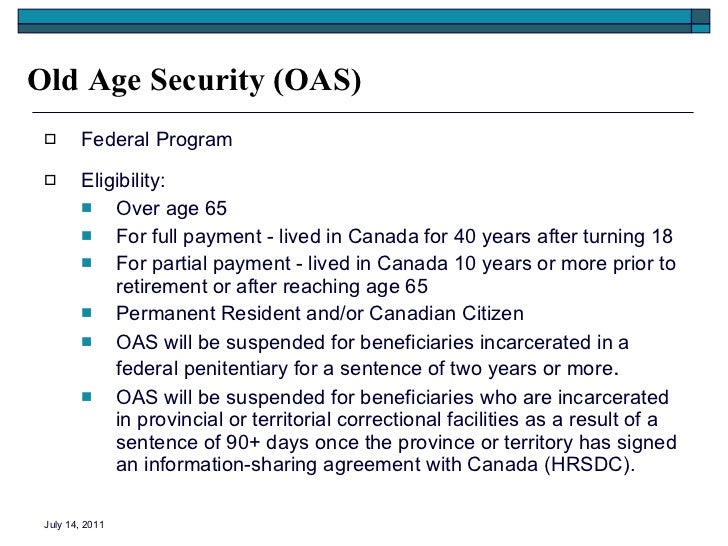

Oas pension is a monthly payment benefit that most canadians are eligible for at 65 years of age and older.

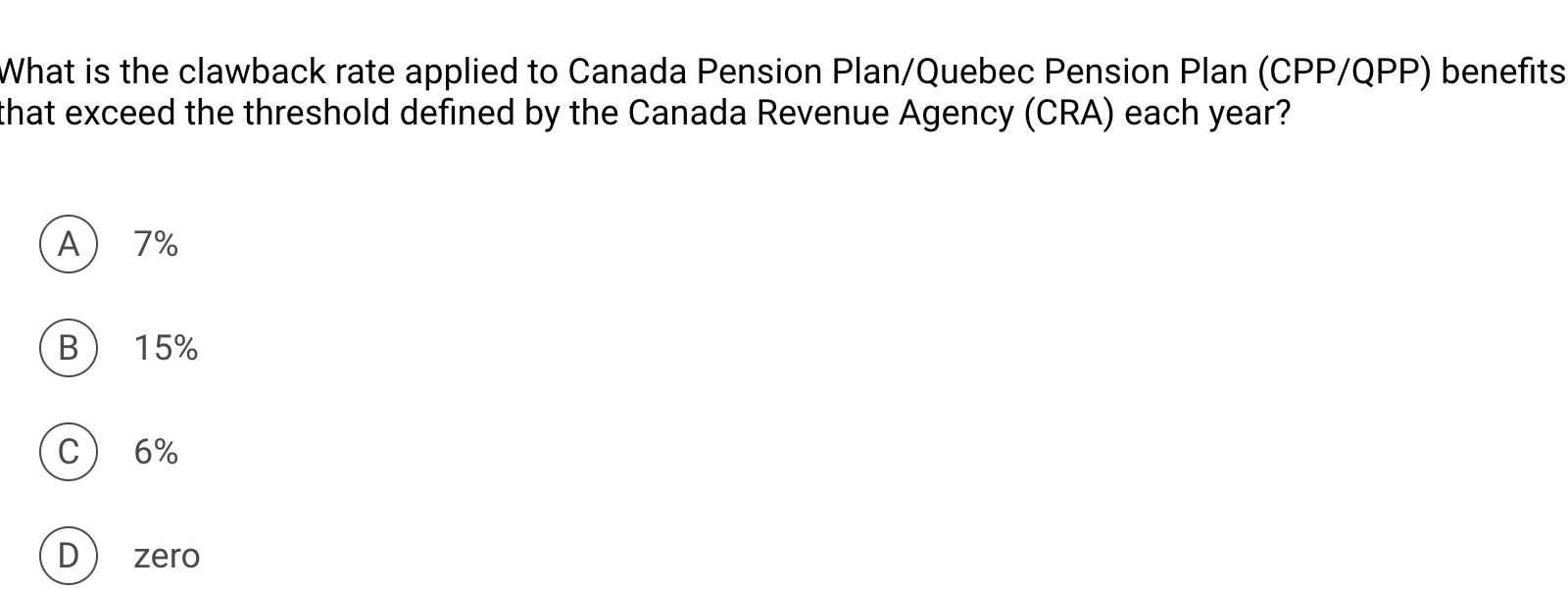

10 Ways To Minimize the Old Age Security (OAS) Clawback, If your income exceeds a certain threshold, you may have to repay some of your oas pension. All you need to know about the old age security pension, including oas amounts, 2025 payment dates, application, eligibility, & oas clawback.

What is Old Age Security (OAS) and why would I have to pay it back, Seniors must pay back all or a portion of their oas (line 11300 of the tax return, line 113 prior to 2019) as well as any net federal supplements (line 14600, line 146 prior to. This is called the old age security pension recovery tax (or oas.

Canada Old Age Pension 2025 OAS Payment Dates, Amount, Eligibility, To determine your payments, use the old age. Oas clawback results in a reduction of oas.

TaxTips.ca Old Age Security Pension (OAS) clawback, Your age (65 or older) how long you have lived in. Its official name is the old age security pension recovery tax and it starts to kick in when the annual taxable income of a recipient reaches a certain threshold.

Cpp 2025 Canada Lotta Rhiamon, Starting in july 2025, the oas clawback thresholds will increase to: Canadians age 75 and older can receive up to a maximum of $784.67 per month.

Canada Old Age Pension 2025, OAS Eligibility Criteria, Benefits, To determine your payments, use the old age. Seniors must pay back all or a portion of their oas (line 11300 of the tax return, line 113 prior to 2019) as well as any net federal supplements (line 14600, line 146 prior to.

Solved What is the clawback rate applied to Canada Pension, To receive a full old age security pension, you must have lived in canada for 10 years, but less than 40 years (after age 18). The old age security (oas) clawback is another name for the oas pension recovery tax.

:max_bytes(150000):strip_icc()/retirement-finances-lge-56a0e58f3df78cafdaa62b2e.jpg)

Canadian Old Age Security (OAS) Pension Changes, Oas clawback results in a reduction of oas. Starting in july 2025, the oas clawback thresholds will increase to:

The Measure of a Plan, All income over and above that amount is subject to clawback. Your age (65 or older) how long you have lived in.

Canada Pension Plan and Old Age Security Overview, Starting in july 2025, the oas clawback thresholds will increase to: Your age (65 or older) how long you have lived in.

Guaranteed income supplement provides monthly payments to seniors who are receiving old age security pension (oas) and have an annual income lower than the maximum.