Ss Contribution Limit 2025. For 2025, the social security tax limit is $168,600 (up from $160,200 in 2025). The 2025 limit is $168,600, up from $160,200 in 2025.

Planning to retire in 2025?3 things you should know about taxes what is the maximum social security benefit in 2025? In 2025, the social security tax rate is 6.2% for employers and.

With the $168,600 wage cap in place for 2025, the maximum that each party would be responsible for is $10,453.20, adding up to a total contribution of $20,906.40 in.

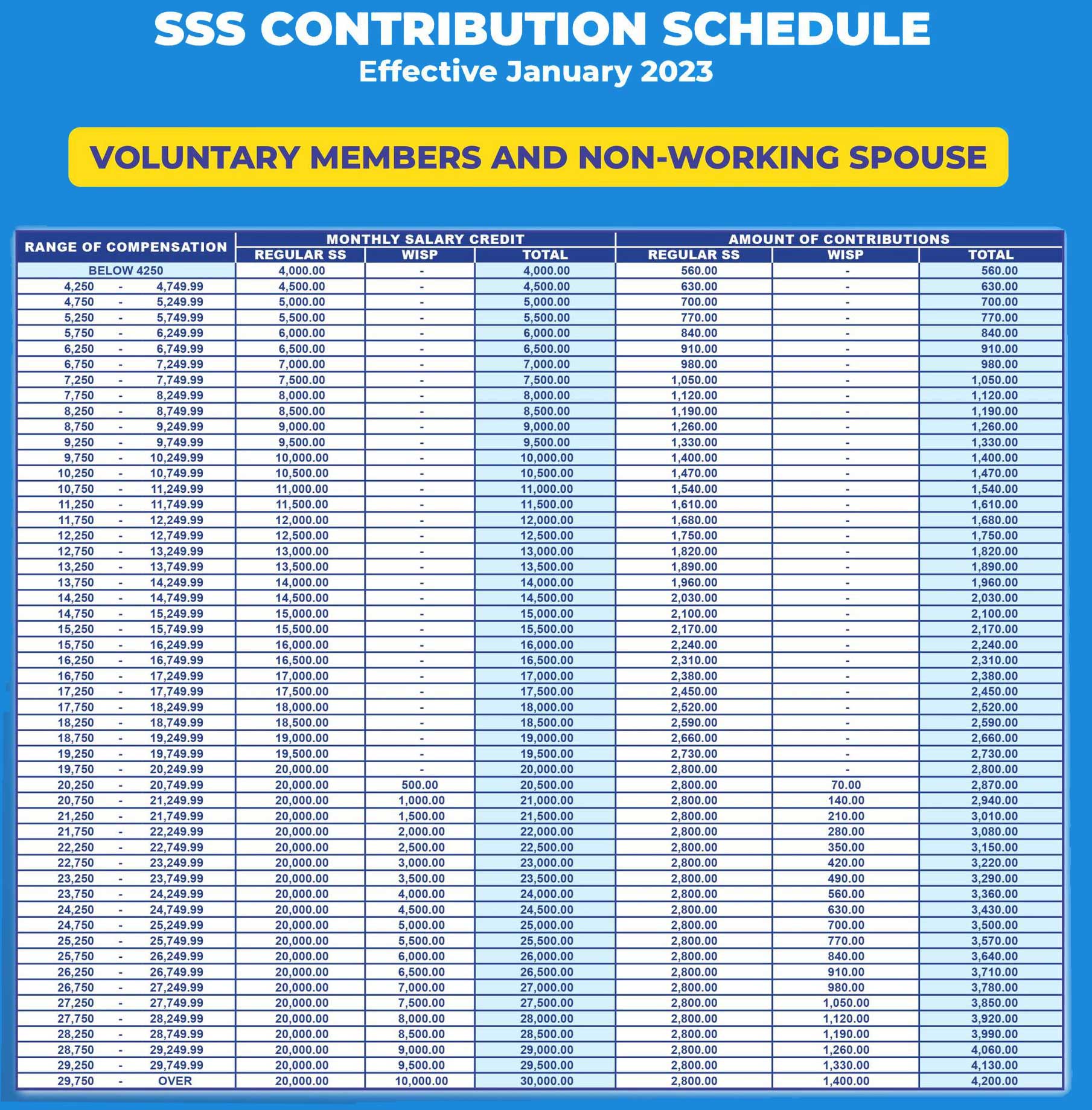

WISP SSS Contribution What to Know About This Savings Program, Earnings limit for people in the. With the $168,600 wage cap in place for 2025, the maximum that each party would be responsible for is $10,453.20, adding up to a total contribution of $20,906.40 in.

SSS Voluntary Members Contribution Table 2025, It’s $4,873 per month if retiring at 70 and $2,710 for retirement at 62. How much your receive depends on several.

2025 Contribution Limits Announced by the IRS, In 2025, for example, the limit is $168,600. As a result, the maximum social security tax jumps from $9,932 to $10,453.

What’s New SSS Contribution Table 2025 QNE Software, In 2025, the social security tax limit was $160,200. It’s $4,873 per month if retiring at 70 and $2,710 for retirement at 62.

Sss Contribution Table How Much Is Your Sss Contribution Para My XXX, With the $168,600 wage cap in place for 2025, the maximum that each party would be responsible for is $10,453.20, adding up to a total contribution of $20,906.40 in. The social security limit is $168,600 for 2025, meaning any income you make over $168,600 will not be subject to social security tax.

New Schedule of SSS Contribution Table 2025 NewsToGov, In 2025, the taxable income limit is $168,600. In 2025, the social security tax rate is 6.2% for employers and.

New SSS Contribution Table 2025 Sss, Contribution, Table, The maximum amount of social security tax an employee will have withheld from. We call this annual limit the contribution and benefit base.

Significant HSA Contribution Limit Increase for 2025, In 2025, the social security tax limit was $160,200. In 2025, the contribution and benefit base is $168,600.

415 Contribution Limits 2025 Perry Brigitta, The social security administration (ssa) announced that the maximum earnings subject to social security (oasdi) tax will increase from $160,200 to $168,600. If you earn above that limit for 35 years in your career, you'll earn the maximum possible social security benefit.

Annual Retirement Plan Contribution Limits For 2025 Social(K), Planning to retire in 2025?3 things you should know about taxes what is the maximum social security benefit in 2025? As a result, the maximum social security tax jumps from $9,932 to $10,453.